Black, Fischer, Michael C. Jensen, and Myron Scholes. "The capital asset pricing model: Some empirical tests." Studies in the theory of capital markets 81.3 (1972): 79-121. (link)

The authors set out to test to test the traditional Capital Asset Pricing Model (CAPM). In the CAPM, the expected risk premiums on individual assets are proportional to the expected return on the market and the asset's systematic risk (market betas):

The authors set out to test to test the traditional Capital Asset Pricing Model (CAPM). In the CAPM, the expected risk premiums on individual assets are proportional to the expected return on the market and the asset's systematic risk (market betas):

\[E(\tilde{R_j})=E(\tilde{R_M})\beta_j \text{ , } \beta_j \equiv \frac{\mathrm{cov}(\tilde{R_j},\tilde{R_M})}{\sigma^2(\tilde{R_M})}\]

Time-Series test:

The authors first set out to test the CAPM by regressing (excess) stock returns on the market return (in excess of the risk free rate):

\[\tilde{R_{jt}} = \alpha_j + \beta_j \tilde{R_{Mt}} + \tilde{e_{jt}} \]

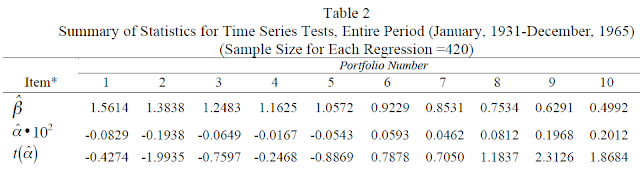

The model implies that alpha is zero for all assets. The authors form ten portfolios of stocks based on their estimated betas in the 60 months prior to the estimation period. Then, at the beginning of each year, they form decile portfolios of the stocks from high beta to low beta that are held for 1 year.

The results show that high beta stocks (portfolios closer to 1) tend to have negative alphas and low beta stocks tend to have positive alphas. The table suggests a CAPM failure.

Cross-Sectional Test:

The authors suggest another test inspired by the formulation above. The authors suggest regressing the average returns of the portfolios on their estimated betas. The figure below captures the main result. Across the 10 portfolios, average stock returns appear linearly related to betas, but contrary to the model the intercept is "too large" and the security market line is too flat.

The authors suggest that a two factor model from Black (1970), motivated by an inability for investors to borrow at the risk-free rate, might better capture the data:

\[ E(\tilde{r_j}) = E(\tiled{r_z})(1-\beta_j)+E(\tilde{r_M})\beta_j \]

The first term now represents the "zero-beta" rate which is above the risk-free rate and captures a return on a zero beta asset.

This paper is notable for early tests of the CAPM as well as testing procedures, time series and cross-sectional, that have continued to be refined and are still widely applicable today.